By Archi Stewart [Assisted by OpenAI & Grammarly].

Preface

Amongst the John LeCarre and Jeffery Archer, I like to pick up a loftier tome from time to time. The last few, whilst on wildly different topics, had at their heart a notion that people today are as they were thousands of years ago; more below. A client, Claire, influenced this article. As an antidote to the macroeconomic instability and the chronic productivity malaise so maligning UK PLC, Claire hit upon a simple, reductionist business policy. Make her business a shrine of calm and stability for staff and investest heavily in their development to beat the stagflation trap of increased costs of living paired to flat wages and instead bet on increased productivity leading to excess profits shared with her teams for long-term growth. The cognitive leap of thought, led to this article.

Claire Robinson, Managing Director – Wrekin Sheetmetal

Introduction

George Maher emphasises that people in the past were not so different from people today. Despite the passage of time and technological advancements, human nature remains fundamentally consistent. By understanding this concept, we can better appreciate the parallels between the Roman Empire’s decline and our contemporary world. Maher’s work reminds us that we must not view historical figures and societies as distant or detached from our own experiences; instead, we should acknowledge the common threads that connect us through time.

Moreover, Maher underscores the importance of history in helping us predict and shape the future. By closely examining historical events, we can identify patterns and trends that may reemerge in modern times. This understanding allows us to make more informed decisions and avoid repeating past mistakes – or at least, we hope so! Ultimately, studying history is not merely an intellectual exercise but a tool that empowers us to navigate the complexities of the present and build a better future.

As George Santayana famously said, “Those who cannot remember the past are condemned to repeat it.”

Maher’s work demonstrates the wisdom of this adage and encourages us to remain vigilant in our quest for knowledge and understanding.

George Maher dives deep into the historical comparison between the decline of the Roman Empire and the contemporary political and economic landscape. The book offers an insightful and thought-provoking examination of the factors that contributed to the fall of Rome, drawing striking parallels to current events. In this blog post, I discuss the critical points, as I recall and understood them, raised by Maher and analyse their relevance to our world today.

Pugnare: Economic Success and Failure

Table of Contents

- Commodus and Trump; Erosion of Faith in Public Institutions

- Populist Decisions and Economic Crisis: The Legion Pay Increase

- Understanding the Roman Coin System

- The Antidote to Crisis: Debasing Gold Coins (Quantitive Easing Roman Style)

Commodus and Trump: Erosion of Faith in Public Institutions

In his book, Maher draws an intriguing comparison between the Roman Emperor Commodus and former US President Donald Trump. Both leaders, Maher argues, significantly eroded public faith in their respective institutions through their actions and rhetoric. One of the key similarities between the two is their penchant for making divisive decisions that undermined the stability of their governments.

Commodus, who reigned from 180 to 192 AD, is famously known for his erratic behaviour, which included participating in gladiatorial games and proclaiming himself a god. Maher highlights that these actions weakened the Roman Empire’s political structure and eroded the public’s trust in their institutions.

“Commodus’ grandiose and reckless behaviour caused a shift in the perception of the Roman Empire, creating disillusionment and mistrust among its citizens.”

– George Maher, Pugnare: Economic Success and Failure.

Similarly, Donald Trump’s presidency was marked by controversial policies and divisive rhetoric that fractured the American public’s trust in their government. From the travel ban implementation to handling the COVID-19 pandemic, these decisions fueled a growing sense of distrust and disillusionment.

Populist Decisions and Economic Crisis: The Legion Pay Increase

Maher discusses the economic crisis that arose from populist decisions in both the Roman Empire and the contemporary world. In Rome, the problem stemmed from a decision to increase pay for the legions, an unsustainable burden on the empire’s economy.

This pay increase was initially popular among the soldiers and the public. Still, it soon became apparent that the Roman treasury could not bear the financial weight of these increased wages. As a result, the empire was forced to take drastic measures to fund the pay raises, such as raising taxes and cutting other government expenses. These actions further strained the already struggling economy and contributed to the eventual decline of the Roman Empire.

“The decision to increase legionary pay was a short-sighted, populist move that ultimately weakened Rome’s economic foundations and hastened its decline.”

– George Maher, Pugnare: Economic Success and Failure.

In the modern context, Maher points to similar economic challenges arising from populist decisions. For instance, governments may implement tax cuts or social spending programs to win public favour, but these actions can create unsustainable deficits and long-term financial instability.

Understanding the Roman Coin System

Maher delves into the intricacies of the Roman coin system to better comprehend the economic crisis faced by the Roman Empire. The primary coins in circulation during the height of the empire were:

- The aureus (gold coin)

- The denarius (silver coin)

- The sestertius (bronze coin)

- The as (copper coin)

These coins had specific values in ratio to each other. However, as the economic crisis worsened, the empire’s leaders were forced to devalue their currency to maintain financial stability.

The Antidote to Crisis: Debasing Gold Coins (Quantitive Easing Roman Style)

Commodus resorted to debasing their currency, mainly gold coins, to address the economic crisis resulting from the legion pay increase and other unsustainable spending. By adding copper to the gold coins, they effectively practised quantitative easing, temporarily alleviating the financial pressure on the empire.

“The Roman solution to their economic woes was to debase their gold coins by adding copper, effectively diluting the value of their currency to create more money for the state. This was an ancient form of quantitative easing.”

– George Maher, Pugnare: Economic Success and Failure.

However, this decision had severe long-term consequences. As the value of gold coins decreased, inflation soared, leading to an economic collapse that significantly contributed to the decline of the Roman Empire.

Governments have also turned to quantitative easing to address financial crises in the contemporary world. Although this approach can provide short-term relief, Maher cautions that, as seen in Rome’s example, it may also have unintended negative consequences in the long run.

“The story of Rome’s debased gold coins serves as a stark reminder that quantitative easing, while sometimes necessary, can have disastrous consequences if not managed carefully and responsibly.” – George Maher, Pugnare: Economic Success and Failure.

Conclusion

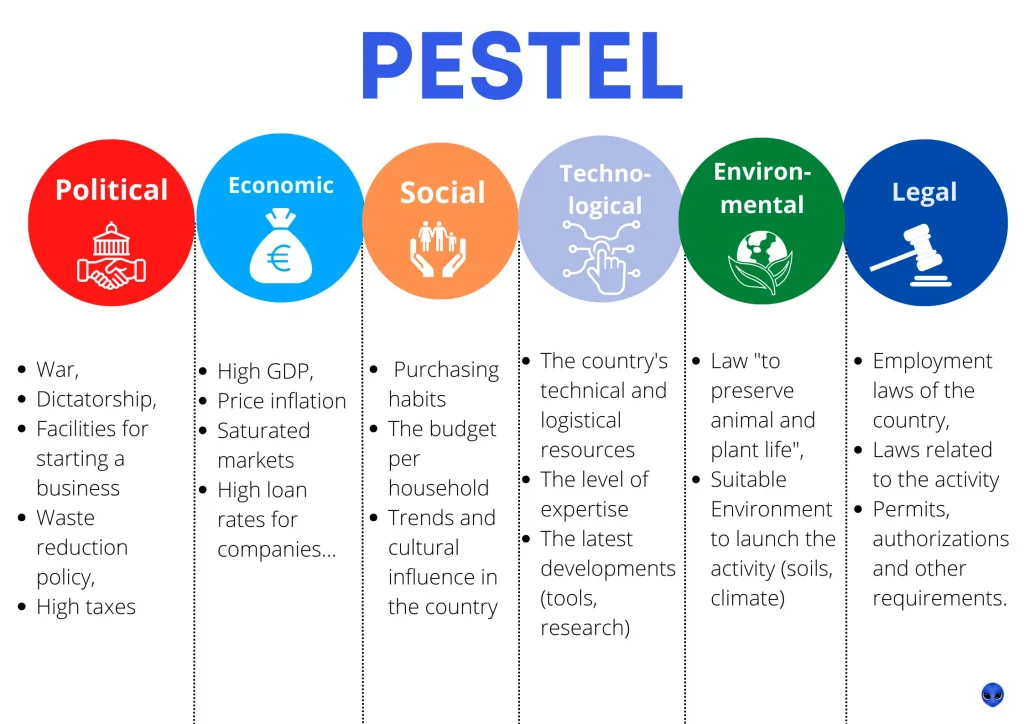

George Maher offers a thought-provoking analysis of the parallels between the decline of the Roman Empire and the contemporary political and economic landscape. His comparison is almost unnerving, as such it makes a compelling argument for searching history for lessons we can apply today. Seeing macroeconomic conditions influence SME business policy and strategic planning adds a nice reminder to strategists and business owners not to gloss over the PESTEL analysis in the strategy process too.

For more on Strategy, free tools and resources click here.